China Quote 🗩

“First and foremost, we will defend our homeland, our borders and our skies, Second, we will work with our partners and allies to deter aggression in the Indo-Pacific from the Communist Chinese. And finally, we will responsibly end wars to ensure that we prioritise our resources to reorient to larger threats.”

Pete Hegseth- Nominee, United States Secretary of Defence

The Chinese Trade Surplus and its Consequence: Explained

Priyanka Garodia – Geopolitical Research Analyst

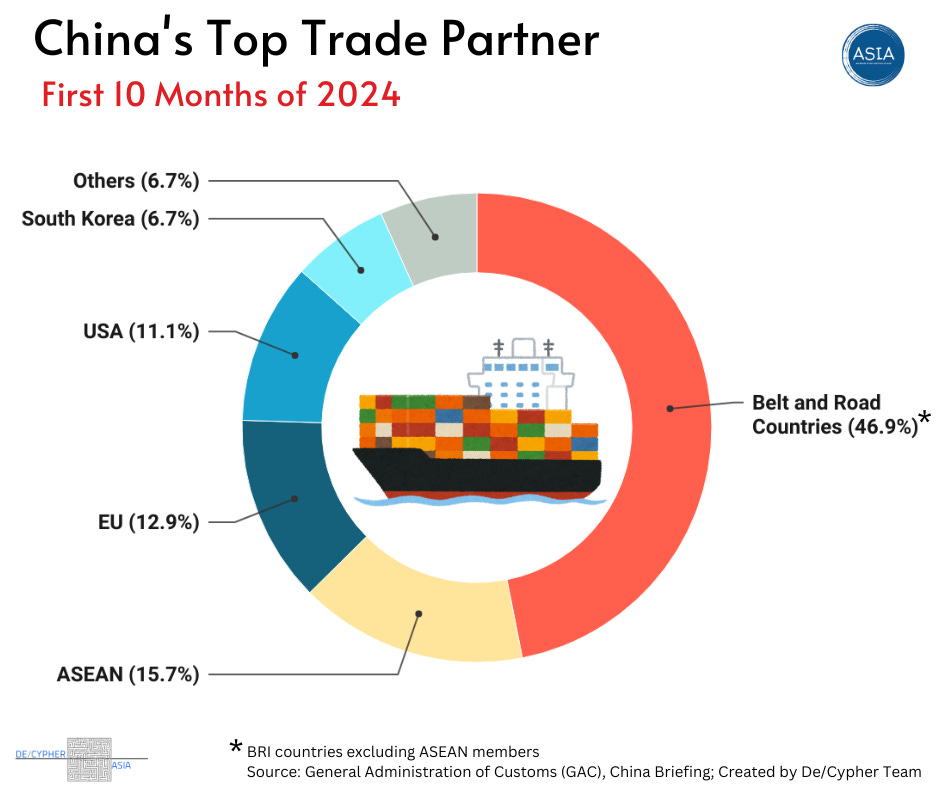

China’s trade with countries involved in the Belt and Road Initiative totalled RMB 16.94 trillion (US$2.37 trillion), growing by 6.2 percent. Exports to Association of Southeast Asian Nations (ASEAN) increased by 12.5 percent, indicating strong demand for Chinese goods.

China has broken records with its trade surplus reaching nearly $1 trillion in 2024, the highest ever recorded, underscoring its position as a global export powerhouse. The surplus generated due to strong shipments to the US and other markets including ASEAN and the EU, comes at a time when Donald Trump is to be sworn in to the Oval Office. Trade tensions are high and his strong stance on imposing a tariff cap of up to 60% on all foreign goods will have an impact on trade with China. While the surplus allows China to renew investments into projects like the Belt and Road Initiative (BRI), it allows proves how vulnerable the Chinese market could be to imbalanced trade.

What Leverage does a Trade Surplus Allow?

China’s trade surplus is a combination of high export demands and restrained import growth. China has managed to establish itself a powerhouse for manufacturing and export but still deals with low consumption rates domestically. Chinese firms have been participating in a very strategic front-loading of exports, possibly, in anticipation of US tariffs under Trump. While these measures could offer temporary relief to the Chinese, the aggressive nationalism touted by the Americans and its consequent trade restrictions could result in tumbling numbers.

The trade surplus for Beijing, offers a vital financial buffer to weather external pressures while continuing to invest in large-scale projects under the BRI. However, it also serves as a stark reminder that China has always been overly reliant on external demand and exports with limited domestic consumption, something is has wished to correct with stronger policies in recent times. The vast majority of China’s exports are driven by foreign markets, especially the United States and European Union. This makes China’s economy particularly vulnerable to global trade fluctuations, such as shifting demand in key markets or trade disruptions resulting from geopolitical tensions including a trade war with the United States.

What Next for the BRI?

The BRI is a global infrastructure project that was launched in 2013 and is Central to China’s vision of creating connectivity between Asia, Europe and Africa. It has been an important project in building and sustaining China’s global influence. Whether it be railway projects in Southeast Asia or ports build strategically in Africa, the BRI has allowed China to emerge as a leader in building world infrastructure. The trade surplus bolsters Beijing’s ability to finance these projects, enabling continued expansion despite rising global scrutiny.

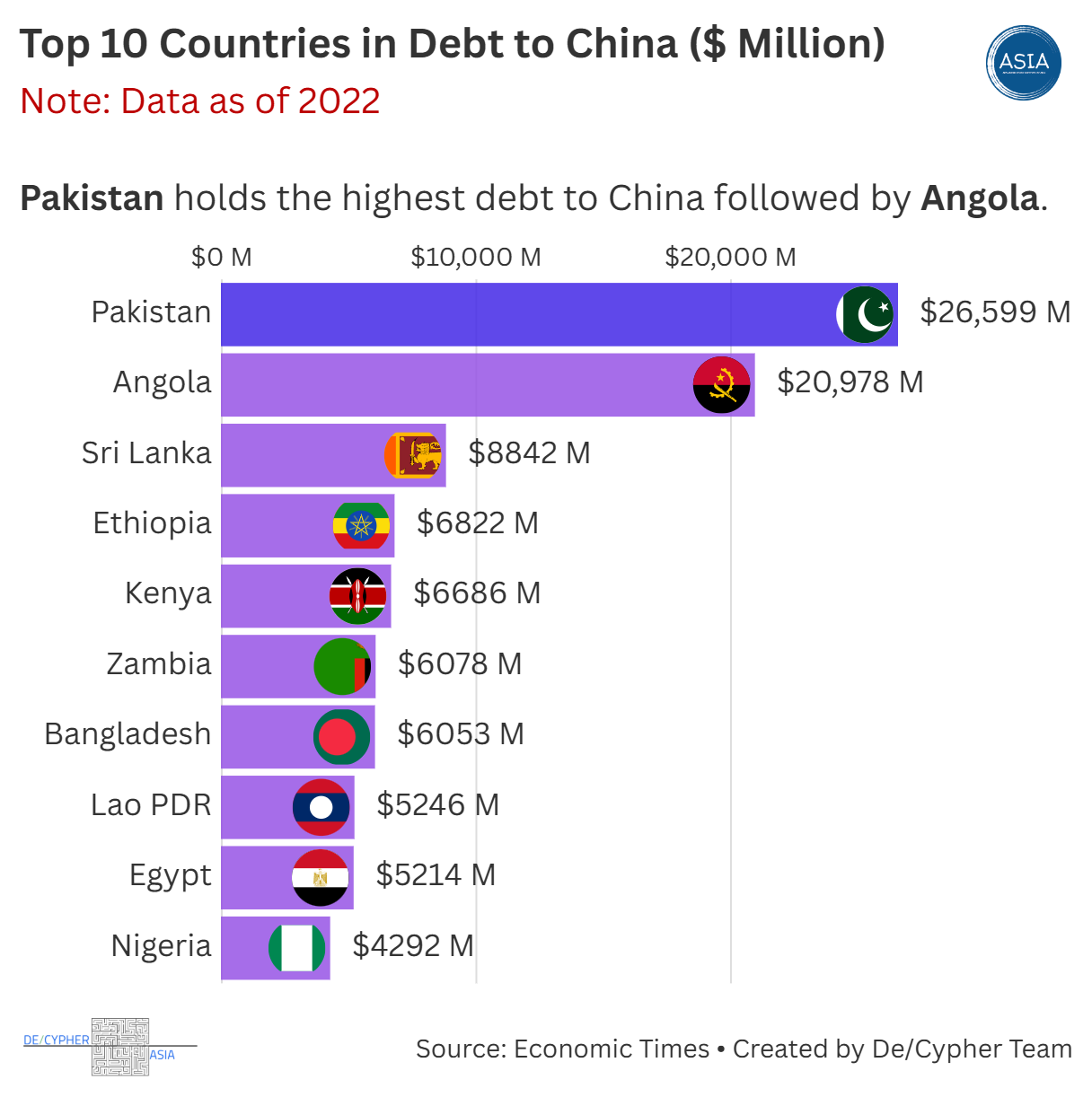

The BRI however, comes with its own set of controversy. China has been accused of using the project to exploit countries that it knows to be economically vulnerable. It does so through what is known as debt-trap diplomacy – a narrative that says China strategically engulfs these countries into unsustainable debt. This allows China to extract geopolitical leverage from these countries through the strategic acquiring of assets on non-repayment of loans. The case of the Hambantota Port of Sri Lanka is a widespread example of this narrative.

However, this should be taken with a grain of salt, as a lot of the issues that lead to non-payment of loans are a product of the structural weakness of these countries and less-so the predatory nature of the Chinese state. The narrative of branding the Chinese state as opportunist – oversimplifies complex financial and governance dynamics. In many cases, debt distress stems from domestic issues within recipient countries—such as corruption, poor project management, and fiscal mismanagement—rather than predatory lending by China. One must also exert caution in accepting this narrative as it takes away agential powers from developing countries in exercising their economic decision-making ability. Examples of this would be the withdrawal of BRI projects by Malaysia, Pakistan and Kenya due to local economic constraints and governance issues. Beijing, for its part, has shown a degree of flexibility, restructuring loans and even writing off certain debts to mitigate backlash. These actions suggest a pragmatic approach to preserving its global influence while addressing reputational risks.

What Next for China?

Given the volatility of the global economic landscape, China’s trade surplus and possible room to invest in the BRI anew, is reflective of the broader strategy that China fosters towards consolidating its economic influence worldwide. The surplus again reinforces China’s ability to question western financial institutions and offers developing countries an alternate source of aid.

This is not without challenge though. The Trump presidency with its unpredictability is expected to exacerbate trade tensions and to adopt a hardline stance on containing Chinese growth. Initiative like the Build Back Better World- a US initiative and Global Gateway – an EU project have been developed to balance the BRI. While Chinese financing has accelerated infrastructure development, it has also raised questions about sovereignty, fiscal sustainability, and dependency. Countries will need to navigate these partnerships carefully, balancing the immediate benefits of Chinese investment with the long-term risks of debt exposure and camp politics.

Conclusion

China has marked yet another economic milestone in its trajectory of growth allowing it to substantiate its influence and to let the US know that it still is an economic powerhouse. This could possible change with the incoming Trump administration but we would just have to sit and wait. China has displayed adaptability and debt sustainability in the past and one should not dismiss Beijing’s ability to shape the global order. The only possible fallout from a trade war between the two giants would be the smaller developing nations who would get ensnared in this great game.

US AI Export Controls: Targeting China and Reshaping Global Dynamics

Aurko Chakrabarti- Applied Geopolitical Researcher

As Joe Biden prepares to leave the White House, he has renewed his focus on ensuring the long-term impacts of his policy decisions. In an effort to protect the US’ diminishing leadership in AI innovation, the Biden administration has implemented sweeping AI export controls, targeting China and redefining global technology access.

The new policy entails stringent measures to control the supply of AI technology, with allies like Japan and the UK among 18 allies with unfettered access. 120 countries have been placed under a restrictive list while established rivals such as China, Russia, and Iran face an indefinite blockade. Software companies like Nvidia, which derives 17% of its sales from China, face revenue hits, while US-based cloud providers like Amazon and Microsoft face strict deployment caps outside the US.

China has condemned the measures as “politicised and weaponised” economic policies designed to maintain US hegemony. Foreign Ministry spokesperson Guo Jiakun criticised the restrictions for destabilising supply chains and creating global inequality in AI development. China vowed countermeasures to protect its enterprises, asserting its role as an advocate for inclusive global AI governance.

The restrictions also include new blacklisting measures. Zhipu AI and Sophgo, linked to Huawei, were added to the US Entity List for advancing China’s military AI capabilities. The rules aim to close loopholes in technology diversion and reinforce export controls on chip factories and packaging companies.

The US has framed the policy as essential for alleviating threats to national security, while maintaining global stability. Critics argue it stifles innovation and risks slowing international collaboration. Donald Trump’s return to the White House is unlikely to disrupt the effectiveness of these measures, as they align closely with his ‘America First’ agenda. With China nipping at its heels, these regulations demonstrate the US’s commitment to staying ahead while attempting to derail China’s progress.

Economic Activity🏦

PBOC Dials Up Short-Term Liquidity Injections Amid Cash Squeeze

Bloomberg reports that the People’s Bank of China injected 958.4 billion yuan via seven-day reverse repo agreements, marking the second-highest liquidity injection on record. This move comes ahead of the Lunar New Year to ease a cash crunch that had elevated interbank funding rates. The PBOC has increasingly relied on short-term tools like reverse repos, shifting away from medium-term lending facilities, to manage liquidity and stabilise borrowing costs.

China’s Top Political Adviser, Wang Huning, Reaffirms Support for Private Economy

Carol Yang writes in SCMP that Wang Huning has pledged stronger support for China’s private sector, which contributes over 60% of GDP and employs 80% of the urban workforce. At a national meeting, Wang encouraged entrepreneurs to overcome challenges, while new laws aim to ensure fair competition and safeguard private property. However, concerns about unclear long-term goals and local enforcement practices persist, reflecting cautious optimism among investors.

China Vanke’s Hong Kong Shares Drop 8% After Report of CEO Detention

The Star reports that shares of China Vanke plunged 8% following reports of CEO Zhu Jiusheng’s detention. A Shenzhen government task force has reportedly taken control, with potential for a government takeover. Vanke, previously a top property developer, is grappling with debt crises and bond selloffs, reflecting broader turmoil in China’s real estate sector.

China is Scouring the Globe in Search of New Food Suppliers

Business Times reports that China is diversifying food imports to reduce reliance on Western suppliers amid geopolitical tensions. Efforts include sourcing macadamia nuts from Kenya, avocados from Africa, and lobsters from Vietnam, now China’s top supplier. This strategy aims to enhance food security and navigate trade shocks as global agricultural dynamics shift, favouring countries from the Global South.

Inside China🐉

China’s Population Declines for 3rd Straight Year in 2024

Kyodo News reports that China’s population fell by 1.39 million in 2024, marking the third consecutive annual decline. Despite policies encouraging childbirth, the birthrate only slightly improved to 6.77 per 1,000 people. The aging population continues to rise, with those aged 65+ reaching 15.6%. Experts cite economic pressures on young couples as a barrier to reversing this trend.

China’s State Security Forces Given New Powers to Oversee Key Building Projects

South China Morning Post reports that China’s Ministry of State Security will supervise construction and alterations of sensitive government and military facilities under new rules effective March 1. Local agencies will oversee security permits, conduct inspections, and manage compliance. These measures align with President Xi Jinping’s “total national security” vision amid heightened concerns over foreign espionage targeting key infrastructure.

Trump’s Greenland Bid Stirs Debate in China About What to Do with Taiwan

Reuters reports that U.S. President-elect Donald Trump’s threats to annex Greenland and the Panama Canal have sparked discussions on Chinese social media about Taiwan. Some Chinese commentators suggest this could open opportunities for Beijing to assert its claims over Taiwan, while others emphasise that Taiwan remains an internal matter for China. Experts argue Trump’s transactional diplomacy style may influence future geopolitical dynamics.

China Building New Mobile Piers That Could Help Possible Taiwan Invasion

Financial Times reports that China is constructing mobile piers designed to aid amphibious landings, potentially for a Taiwan invasion. Satellite images reveal barge-like vessels with extendable ramps under construction, enabling heavy equipment to cross mudflats and seawalls. Analysts view this as part of Beijing’s strategy to address logistical gaps in a potential military operation against Taiwan, despite significant geographical challenges.

China and the World🌏

Chinese President Xi Jinping Will Send a Special Representative to Trump’s Inauguration

Didi Tang writes in AP News that Chinese President Xi Jinping will not attend Donald Trump’s inauguration, instead dispatching Vice President Han Zheng as his representative. This symbolic gesture aligns with Beijing’s diplomatic approach, balancing protocol with engagement. Experts suggest China seeks dialogue amid growing U.S.-China tensions, as Trump’s administration signals a harder stance against Beijing.

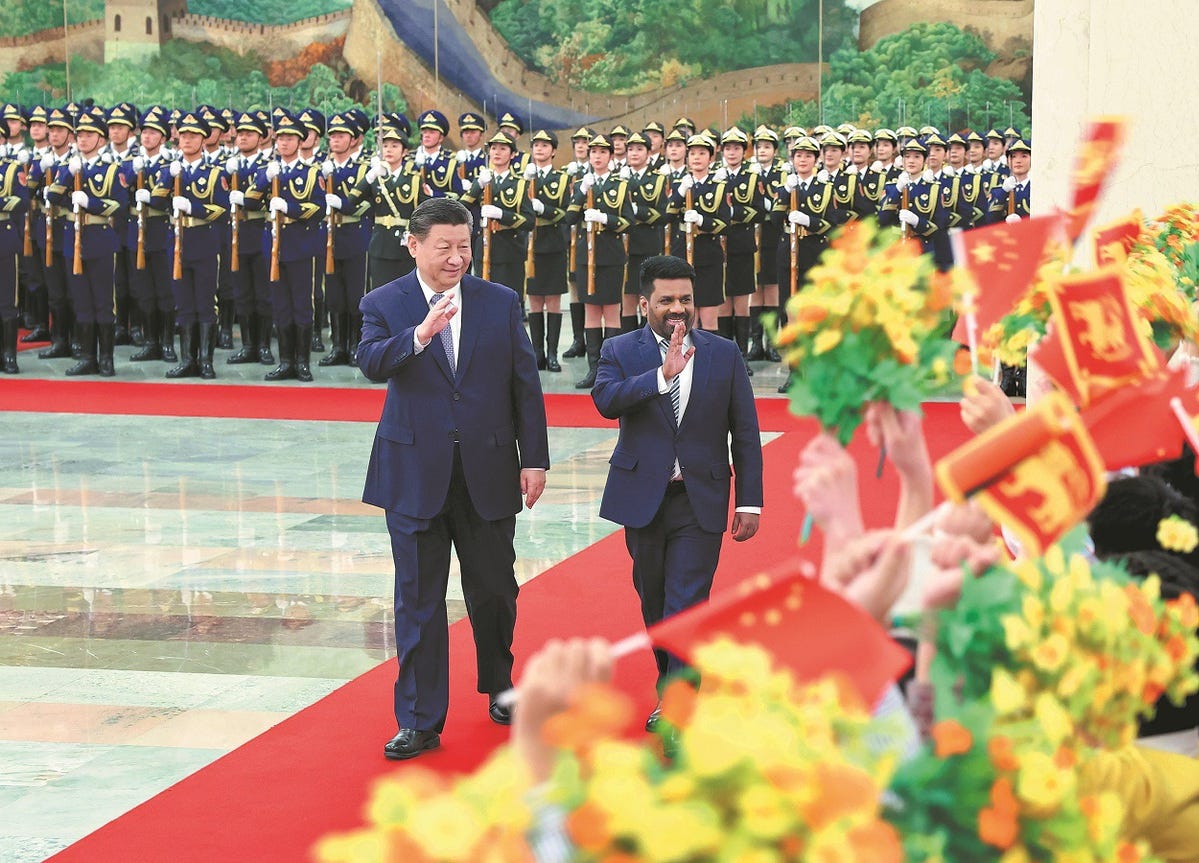

China, Sri Lanka Bolster BRI Bond

China Daily reports that Chinese President Xi Jinping and Sri Lankan President Anura Kumara Dissanayake signed agreements to enhance Belt and Road Initiative (BRI) cooperation, including agricultural exports from Sri Lanka to China. Xi pledged support for Sri Lanka’s economic development, while Dissanayake highlighted China’s role as a reliable partner. Both leaders emphasised collaboration in infrastructure, energy, and digital transformation, strengthening ties within the Global South.

Xi Urges China, Vietnam to Boost Connectivity and Cooperation

CGTN reports that Chinese President Xi Jinping, during a call with Vietnamese Communist Party leader To Lam, emphasised strengthening cross-border industrial and supply chains. He highlighted cultural and high-level exchanges to foster socialist development. Lam praised China’s economic achievements and expressed condolences for losses caused by the Xizang earthquake. Both sides aim to deepen cooperation in theory, practice, and cultural engagements.

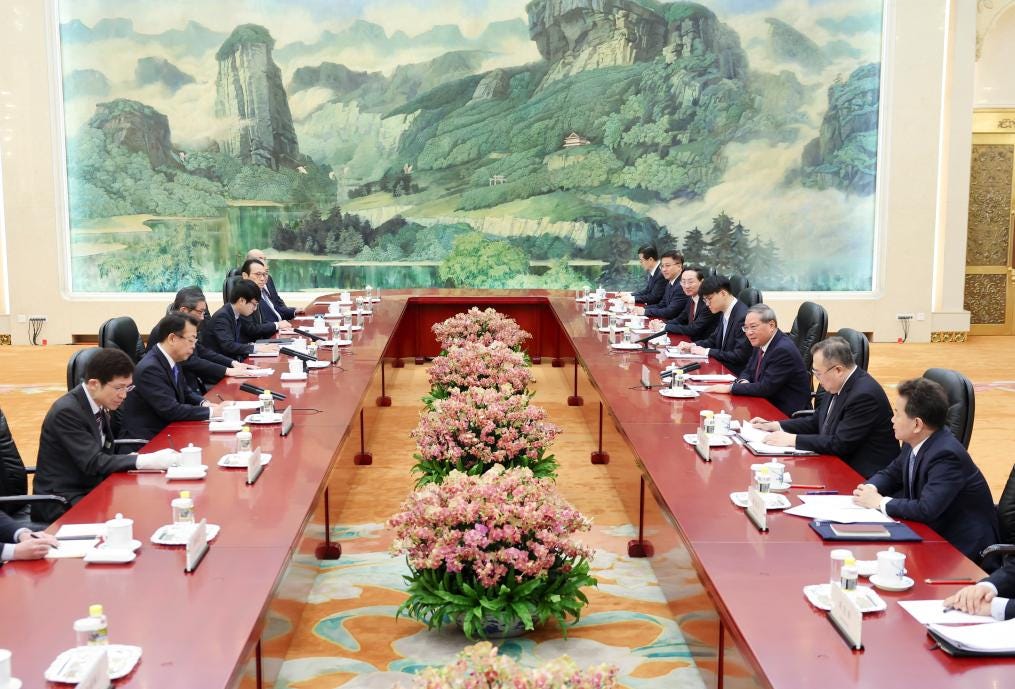

Chinese Premier Meets Delegation of Japan’s Ruling Coalition

Xinhua reports that Chinese Premier Li Qiang met with a Japanese delegation led by Secretary-Generals Hiroshi Moriyama (Liberal Democratic Party) and Makoto Nishida (Komeito Party) in Beijing. Li emphasised the importance of enhancing trust, deepening cooperation, and managing differences to strengthen bilateral ties. Both sides highlighted the significance of the ruling party exchange mechanism and expressed commitments to fostering collaboration in innovation, green development, and youth exchanges.

China Expresses Grave Concern Over Dutch Curbs on Semiconductor Exports

Xinhua reports that China has voiced strong opposition to the Netherlands’ tighter export controls on semiconductor equipment and software, calling them a threat to the global semiconductor supply chain. China’s Ministry of Commerce urged the Netherlands, as a WTO member, to uphold market principles, safeguard international trade rules, and ensure global supply chain stability.

Looming TikTok Ban Takes US Citizens Closer to China

China Daily reports that the potential US ban on TikTok has led to a surge in American downloads of Xiaohongshu, a Chinese social media platform. This shift is seen as both a protest against the ban and a defence of free speech. Many users express interest in learning about China, highlighting growing resistance to US policies restricting Chinese platforms.

TikTok Denies Report of Possible Sale to Elon Musk as ‘Pure Fiction’

BBC reports that TikTok dismissed claims of a potential sale of its US operations to Elon Musk as “pure fiction.” The Bloomberg report, which cited unnamed sources, suggested Chinese officials were considering this option if the Supreme Court upholds a ban on TikTok. TikTok has repeatedly stated it will not sell its US operations. The Supreme Court is set to rule on legislation requiring TikTok to sell or face a US ban by 19 January.

Is China Using ID Cards to Influence Taiwan?

DW reports that Taiwan is investigating claims of citizens holding Chinese ID cards, which provide benefits such as loans and business opportunities. A viral video revealed efforts to encourage Taiwanese to apply for these IDs, raising concerns about China’s “united front” tactics. Taiwanese authorities warn such actions could undermine national identity, while analysts suggest the move aims to create divisions within Taiwan rather than foster unification.

Tech in China🖥️

Space Version of China’s NearLink Wireless Module ‘Cuts Latency to Microseconds’

SCMP reports that China has developed a space-grade version of its NearLink wireless communication module, known as “Aerospace NearLink,” which completed a successful test flight. Designed to replace cables on heavy rockets, it reduces latency to microseconds, slashes data packet loss, and cuts power consumption by 40%. This innovation could significantly lower rocket launch costs and marks a step toward fully wireless rocket systems.

Chinese AI Company MiniMax Releases Models Claiming Industry Competitiveness

TechCrunch reports that MiniMax, a Tencent- and Alibaba-backed AI startup, unveiled three advanced models: MiniMax-Text-01, MiniMax-VL-01, and T2A-01-HD. The models target text analysis, multimodal tasks, and speech generation, respectively. Notably, MiniMax-Text-01 features an unprecedented 4-million-token context window, vastly surpassing competitors like GPT-4o. While claiming strong performance, MiniMax faces scrutiny over its restrictive licensing and alleged use of copyrighted content for training.

De/Cypher Data Dive📊

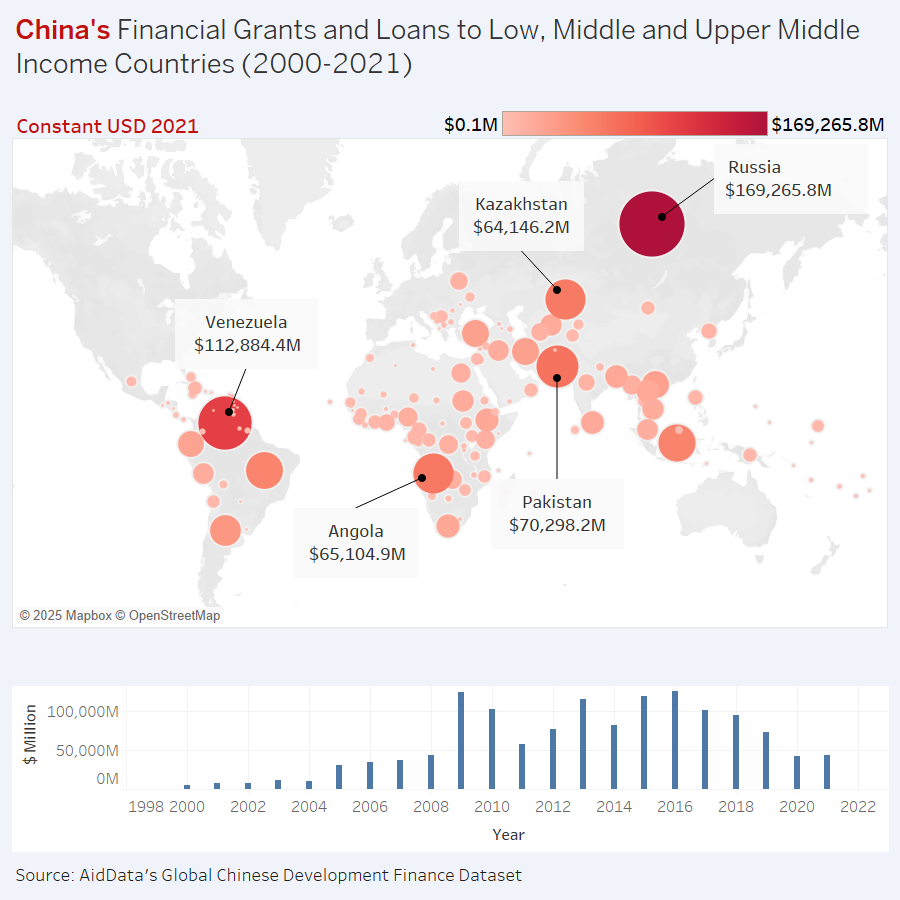

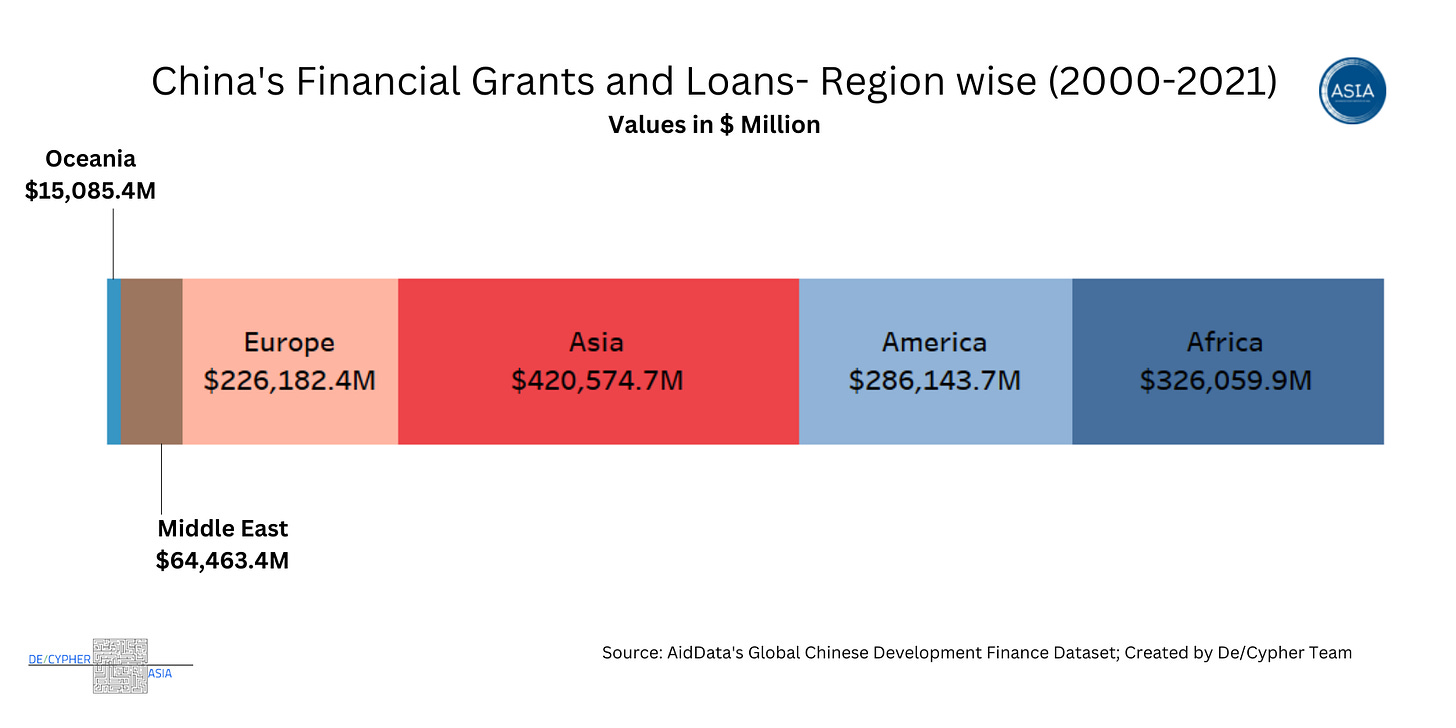

China financed with grants and loans worth $1.34 trillion to low and middle income countries from 2000-2021.

China and Russia have built close financial ties over the past ten years, with Russia becoming the largest recipient of Belt and Road lending.

Beijing has become one of the world’s largest creditors due to its extensive overseas lending under initiatives like the Belt and Road Initiative (BRI). The loans, often provided to low- and middle-income countries, were meant to fund infrastructure projects like roads, railways, bridges, tunnels, power plants, and telecommunication systems.

The Asian region have received the highest financial support from China between 2000-2021. Pakistan is third-largest recipient of Chinese loans, after Russia and Venezuela. In 2021, Angola was the most indebted country to China of any African state. In the same year, 72 per cent of all Angola’s oil exports went to China – making Angola the fifth-largest exporter of oil to China.

Image of the Week📸